Musings from the trading floor (Short and Sweet)

Names in play this week: £DORE, £FSFL, £GSF, £ORIT, £NESF June guest piece re CPI/Energy

20th May 2025

Musings from the trading floor (Short and Sweet)

Names in play this week: £DORE, £FSFL, £GSF, £ORIT, £NESF

June guest piece re CPI/Energy

Equities: UKX -0.76%, Eurostoxx -1.08%, ASX: -.049%, SPX: -1.34%

Credit: IG, 1bps wider, XO 5bps wider

Interest Rates: 1Yr 1bps lower, 10Yr 3bps lower

Pre-close / auction*

Geo-Macro Mania

US: Trump war monger or peace marker. Turning into another great trade setup, buy on his self-created dips, sell on his change of tone.

UK: Held rates, dovish hint, mixed macro data but its all-volatile points, so market not that fussed. Bigger news was the Iranian ambassador comments.

IHT Update..

*RM Funds mandates have an economic interest in the companies covered. *Capital at Risk*, Not a Trade Recommendation*

Well, it’s becoming clear that the smart money is following the IHT trail. The headline news on Friday morning was the announcement of a transaction between Bagnall and the Downing Renewables & Infrastructure Trust (DORE: LN) board - notable for three reasons: the bidder appears to be an IHT vehicle, the target is a diversified renewables yieldCo, and the offer comes at a premium to the undisturbed share price but a c.7.5% discount to NAV. That last point matters - it confirms what most already suspect: NAVs aren’t robust. Still, if both sides are willing to leave something on the table, deals can happen. Looking ahead, FSFL: LN (Foresight Solar) may be next in line, although with fewer votes for discontinuation, it's unclear whether that makes a deal more or less likely. The register has been shifting notably in recent weeks. Meanwhile, ORIT: LN (Octopus Renewables) raises a different question: when you're trading at a c.30% discount, is deploying capital into Irish solar really the best use of funds?? [I know it might/should be accretive to earnings].

Energy and the Supply Chain

Tensions in the Middle East continue to dominate headlines, with the Israel-Iran conflict amplifying risks across key energy and shipping chokepoints. The South Pars/North Dome gas fields – vital for global LNG – faces indirect threats after strikes near its air defences, rising the risk of supply disruptions. Oil prices have surged more than 20% this month (with Shell warning earlier this week of “huge impact to trade”, if there were a blockage of the strait of Hormuz, and yet the muted reaction in global equities and bonds suggest markets expect the spike to be short-lived and see crude as less central to broader risk sentiment than in the past.

However, the underlying risk may be underestimated. A further escalation could trigger persistent inflation pressures through the energy channel, especially as higher energy costs mean more expensive [US] summer driving season. But the impact doesn’t end at the pump – energy prices ripple through the broader economy. Foods, beverages, and household furnishings are particularly vulnerable due to the rising costs filtering through every stage of their supply chain, from manufacturing and transport to retail and installation.

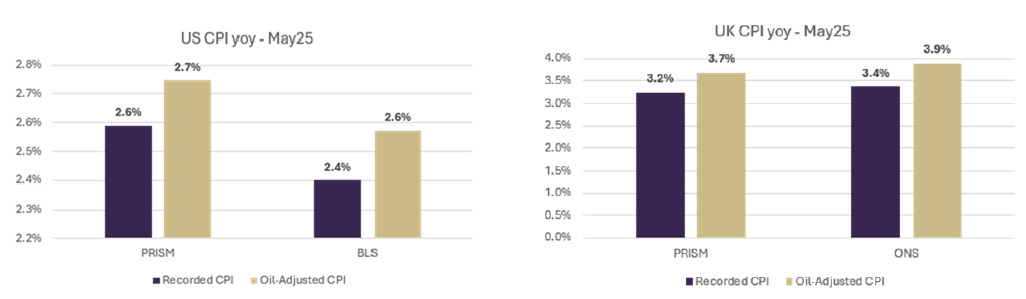

And interestingly, when we adjust the past CPI data to reflect the potential impact of a 20% oil price increase – had the Middle East situation occurred in last month – the picture shifts noticeably. As the two charts show, such a surge in energy costs adds 0.2 percentage points to US headline CPI and 0.5 points to that of the UK, underscoring the significant role energy plays in driving headline inflation. That said, if the situation in the Middle East deteriorates further, gasoline prices could push headline CPI even further from central bank’s targets. While the Fed’s typical response is to look past oil-prices swings, this time may prove different.

Actual Musings

NESF: We along with another investor wrote to the Board, we’re not going to detail all aspects of the letter, but the IMA and the FSFL approach were two key items of focus. We are concerned by what we perceived to be weak corporate governance and will continue to engage constructively.

GSF: RM Funds and our various mandates have announced a 5%+ position in this, stock. It’s an area of focus – this week’s announcement is a start towards unlocking value for shareholders.

CORD: Reported, strong numbers.

Another new bag of beans this week Toby’s Estate, special roast “Panna cotta”, strong taste, good as an espresso, macchiato or cappuccino 7.5/10

The panic buying of a new tux wasn’t great move, crotch ripped at precisely the worst time – and now there is a terrible picture of me somewhere on LinkedIn. Voluntarily gave the Aussie ambassador a few tips about geo-politics 😉

Have a good weekend all, flying to the UK Sunday!

Espressos Consumed SB: 1618

P.