Musings from the trading floor (Ranting Edition)

Names in play this week: £FSFL, £NESF, £ESP, £UTG, £WISE, AED$ DUBAIRES

6th May 2025

Musings from the trading floor (Ranting Edition)

Names in play this week: £FSFL, £NESF, £ESP, £UTG, £WISE, AED$ DUBAIRES

Equities: UKX +0.75%, Eurostoxx +1.11%, ASX: +0.96%, SPX: +1.58%

Credit: IG, 3bps tighter, XO 15bps tighter

Interest Rates: 1Yr flat, 10Yr 1bps lower

Pre-close*

Geo-Macro Mania

US: JOLTs, ADP, NFPs…mixed messages. And lets not forget the Trump v Musk fall out. Trump wants a 100bps cut..

ECB: Cut rate.

JPY: Bond auction wasn’t as bad as expected.

A Planned Departure… Allegedly

The RNS flashes across Bloomberg: NESF: LN announces a “Directorate Change & Chair Succession.” A Chair known for shareholder-minded decisions steps down, effective immediately. The spin begins. According to the SID-turned-interim Chair, it’s all part of a “planned” transition. It didn’t read that way. The tone that follows is one of defiance, with the implication that shareholders are fully aligned with the current direction - a questionable assumption likely rooted in a retail-heavy register.

Then, confirmation of what the market had already been whispering: FSFL: LN had made an approach to NESF: LN - only to be summarily rebuffed. The details remain private, of course, but we’re left to speculate. So, here’s our view: in the absence of an orderly wind-up, it’s entirely rational to consider a merger—FSFL & NESF or another “pure-play” renewables peer. The case is straightforward: improved liquidity, broader platform capability, and a more balanced shareholder base.

Neither side is without flaws - one strayed into Australia and overlooked grid realities; the other’s been busy allocating capital to its LP mandates but standing still isn't an option. Shareholders will, inevitably, act. The real barriers? A Board reluctant to act, a stubborn jurisdictional setup, a handful of investors clinging to a lower rate fantasy, and a manager slow to evolve. But on a long enough timeline, the survival rate approaches zero.

Actual Musings:

ESP: LN / UTG: LN As we suspected there was a suitor stalking the company, turns out it was trade rather than PE. It doesn’t mean there couldn’t be another bid come in, a la AGR: LN / KKR / Stonepeak / PHP: LN.. but it would need to be an all-cash trade. Still very doable in my opinion but the difficulty is if PE think there is another growth in the asset class, given the emerging headwinds in UK PBSA sector. ESP’s own trading update confirms what we have long stated that the sector is finding it hard to cover AY 25/26 forward bookings. The only odd thing about this was the X post, from a journalist which effectively broke the story - who came up with a price target of 125p. I wonder where that figure came from!

DUBAIRES: UH scale back was so painful..Book was 26x oversubscribed, but given banks offer 5x leverage for a fee, the book was likely going to be oversubscribed..

WISE: LN not really in our wheelhouse, but id echo the sentiment here, the UK / LSE / FCA needs evolve – otherwise any growth orientated company of scale will just list elsewhere.

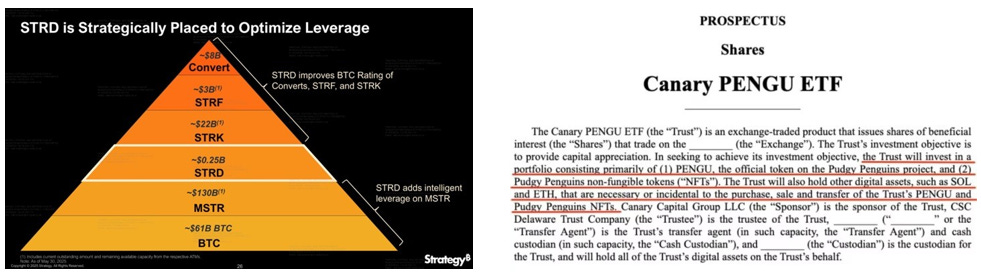

Picture(s) of the Week

Will we look back and say, “there were signs”?

WTF is intelligent leverage?

A new bag of beans this week, from a new supplier “The Espresso Lab”, “Carmo”, Brazil: Mild, daily driver. Hints of chocolate and almond. 6/10.

Its Eid this weekend, so it will be a busy one for activities no doubt.

Have a good weekend all.

Espressos Consumed SB: 1594

P.