Musings from the trading floor (Lite Duties Edition)

Musings from the trading floor (Lite Duties Edition)

26th July 2024

Musings from the trading floor (Lite Duties Edition)

Names in play this week £VOD, BXMT 0.00%↑

Market Wrap

A just positive week for most asset classes, post (UK) close the FTSE 100 circa +1.59%, Euro Stoxx 50 +0.73%, and the S&P 500 -0.78%. Credit spreads (IG & HY) were unchanged on the week with Main/IG: bps and XO/HY:c.+bps. UKT 1yr -6bps on the week.

Macro Mumblings

US: core PCE MoM inline, YoY touch above. But PCE landed inline. GDP stronger, personal consumption higher, initial and continuing claims a touch lower too. But a shockingly week Durable goods order.

Chips & Dips

We touched on this last week, but the data gathering, and analysis has started to answer the ‘simple’ question, “what would a tariff on European silicon chips look like?”, if Trump came into power and Europe didn’t bend the knee to the US. Well, here are some high-level numbers: Semiconductors revenue in Europe is expected to hit $61bn equivalent in 2024, CAGR is expected to annualise at c8.93% with revenues hitting $93bn by 2029. This is significant when you consider China is estimated to generated c. $177bn in 2024 from Semiconductors. Imagine what a 50% tariff looks like. Bye Bye growth, hello recession, hello fractured relations with allies, hello comrade!

Blocked-In

While Carson Block may not be favoured by Blackstone Mortgage Trust (BXMT:US) enough to make their Christmas card list, his insights last year were prescient. His firm highlighted the unsustainable capital stack of the trust, noting the rising defaults and significantly higher refinancing costs (fag packet math caveat here, but refinancing today, excluding break fees and costs, would increase costs by c. 1.90% per annum all-in). Therefore, it was no surprise when the Board decided to reduce the dividend by 24%. And I suspect that might not be the last unexpected move we see from them either.

VOD Telco Trade

Another day, another telecom trade. This time, it's VOD: LN selling off another stake in its tower company, Vantage, which initially listed in Germany before the take private by the KKR / GIP consortium. We've previously discussed the irrational asset allocation strategy of European telecoms owning infrastructure assets rather than operational companies (OpCos) and I've often lamented how the towerCo platform, which only generated around €500 million in EBITDA during FY 20/21 compared to the broader business's €14 billion EBITDA, constituted about 30% of the company's value. Despite this, it didn't translate to benefits for shareholders, with the stock down approximately 50% in price and 27% in total return basis over five years. Now, VOD: LN is divesting an additional 10% for €1.3 billion. Having sold about 50% for €6.6 billion, the remaining 50% still represents around 30% of VOD's current market cap. Still, it seems the real issue is the substantial debt load, which includes over 60 bonds, around 20 loans, and €54 billion in outstanding debt – all that said its one of the more interesting names to trade.

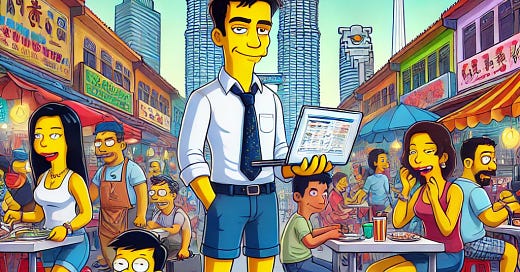

I’m in KL now for summer, so it’s a great culinary mix of Rendang, Dim Sum and Roti – on daily rotation. Sangat Bagus! Aside from that the munchkins have discovered KidZania which is just insane – I am installing that that IBD work ethic in them early! 😉

Espressos Consumed SB: 965

P.