Musings from the trading floor (Late Weekly)

After the excitement of the last few weeks, this past week has been very quiet. And I don’t have that much to talk about..

Musings from the trading floor (Late Weekly)

After the excitement of the last few weeks, this past week has been very quiet. And I don’t have that much to talk about..

Equities: UKX: +1.69%, SPX: +4.73%, EuroStoxx +3.78%, ASX 200 +2.66%.

Credit: IG & XO, -8bps and -40bps tighter respectively.

Interest Rates: UK 10Yr yield about 10bps lower and 1year 9bps lower.

PBSA Assumptions: Not All Comps Are Created Equal

Flicking through a recent valuation report for a new PBSA development up North, a few assumptions caught my eye: Void allowance: 2.5%; OpEx: 22.5%. All fairly standard assumptions (not necessarily values).., except the numbers had been “finessed” even further, with a cheeky 10%+ uplift on the turnkey value. Even so, the agent adjusted turnkey cost per bed at £94.7k didn’t immediately scream crazy. But let’s park the agent’s creative adjustments for a second and focus on just one metric: OpEx. Looking across market comps, OpEx assumptions vary, often running 5% – 17.5% percentage points higher than the figure used here. So what’s the impact if we actually stress test it? Answer: a 10%+ haircut to the valuation, ceteris paribus. Now, reverting to the valuers’ figures (provided from the developer, rather than agent’s turnkey), the implied per-bed cost drops to around £92k, but if we do tweak those OpEx assumptions to more market aligned values (say 32.5% from 22.5%), then we take another leg lower dropping to £82k per bed. One could say that still feels cheap — especially when you consider observed market comps are trading at £125k+ per bed. But if we pause for a second, that would imply a 35%+ uplift in valuation or a pretty heroic 4.51% cap rate for a regional asset. In short: Sure, on paper it looks like a buy. But not all comps are created equal (nor are the assets) and blindly assuming uniformity across assets is a fast way to misprice risk.

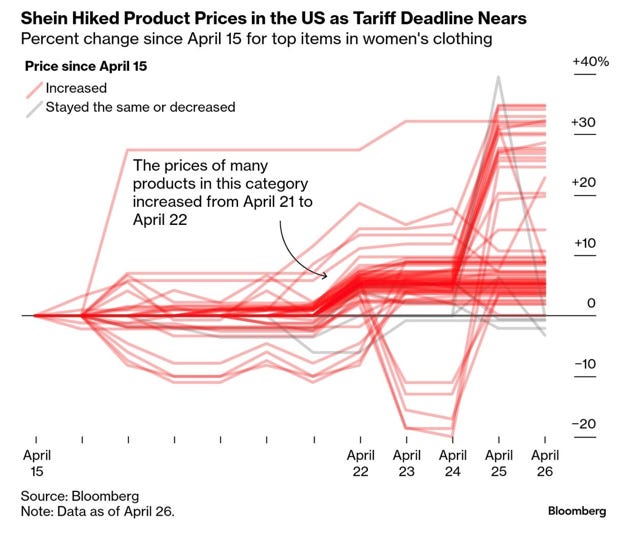

Shein

I haven’t yet had the pleasure of shopping with Shein. Its fast fashion which doesn’t really conform to my beige, white, navy wardrobe. But it was interesting to see the price hikes that are coming to US consumer, with a reported 377% increase in the cost of some goods via the retailer. We have actually created a similar subset of our US CPI price tracker and will publish in the coming week or so. It is starting to feel, at least for the near-to-medium term that this is a US consumer issue now. Lets see, but if we do see significant signs of an uptick in inflation, expect round three of Trump v JPOW.

UAE Property Boom

Every day there is another article about the property boom. And as you look around there are developments everywhere, mostly catering for the mass affluent to UHNW markets. And the off-plan schemes sell out in seconds, you can buy/sell off-plan interests – which is a business in itself.. So, i thought I’d look at a few of the developers bond issues. Chunky yields, for relatively short-dated paper.

Cat Bonds

Truly I’ve never totally got the Catastrophe bond appeal. I have always thought of insurance writers, in the same way as writing call or put options, picking up the pennies in front of the stream roller, unless you price the risk accordingly (I wonder if AI will assist with that statistical endeavour) - and then hedge it out, one day it will be catastrophe. That said the exposure is uncorrelated to more traditional financial assets, that is until you sell the risk to the capital markets. So, I had my eyes on the recently launched Brookmont Catastrophic bond ETF (ILS: US), as it will be interesting to see how it evolves..and what risk is actually in the product.

A whirlwind of coffees this week, I bought a fair few “Specialty Batch Coffees” a roastery specialising in niche farms and emerging processes. And it’s a mixed bag, one or two like Alfaro Estates (choc and nuts, good), are solid, 6.9/10 and one or two are just a little too experimental (Pina Colada, anaerobic fusion, and extended fermentation).. Smells like strawberry cheesecake (seriously), tastes like somebody added 3 sugars! 5.75/10 (need to experiment more with it).

Espressos Consumed SB: 1527 (massive uplift due to many many childern’s birthday parties). Finally saving the best till last happy birthday to my youngest daughter!

P.