Musings from the trading floor (Easter Long Weekend Edition)

Names in play this week: £FGEN, €AXLGRP, £RS1, £ESP, £HEIT, £GSF, €XIOR Lets hope President Trump spends more time on the golf course than X this weekend.

17th April 2025

Musings from the trading floor (Easter Long Weekend Edition)

Names in play this week: £FGEN, €AXLGRP, £RS1, £ESP, £HEIT, £GSF, €XIOR

Lets hope President Trump spends more time on the golf course than X this weekend.

Equities: UKX: +4.58%, SPX: +0.68%, EuroStoxx +2.42%, ASX 200 +1.42%.

Credit: IG & XO, -7bps and -40bps tighter respectively.

Interest Rates: UK 10Yr yield about 10bps lower and 1year flat.

Geo-Macro Mania

US: Comments on Powell…A conflict with Powell and I think we see a 5%+ drop/correction in US Equities.

UK: Inflation a touch lower, but nobody really looking at this months data given next months expected utility bump.

Swimming with the Fishes?

*CAPITAL AT RISK – NOT A TRADE RECOMMENDATION – RM Funds and its funds positions in named securities*

So, it looks like Axolo Group (AXLGRP CORP) successfully closed their bond deal, the bonds settled yesterday according to Bloomberg. We view this as a positive for Foresight Environmental Infrastructure Ltd (FGEN: LN). As a recap the Axolo Group was founded by the management team of Eyvi AS and Hima Seafood AS to create a leading regenerative group within aquaculture. We sent a letter of encouragement to the Board of FGEN this afternoon.

Bat Signal

I recently reserved my spot in the queue for one of Nvidia’s (NVDA: US) desktop AI “supercomputers” (aka: a graphics card in a box), but in the meantime, I noticed RS Group plc (RS1: LN) listing the Nvidia Jetson Nano - essentially a supercharged Raspberry Pi (RPI: LN), as in stock. With 313 units “sold out” in minutes, I quickly and “successfully” placed an order. Come delivery day, nothing. A call to customer service revealed the system was “having one of those days”—flagging phantom stock, charging your card, and then sitting on the cash for 7–10 days before refunding. Naturally, I was a little sceptical. Over the past week, the same product has reappeared as “in stock” on multiple occasions, first showing 60+ units, then eight this morning. A quick round of follow-up calls to customer services confirmed: no actual inventory exists.

By my back-of-the-envelope calculation, that’s potentially 379 ghost orders, up to £100k in customer funds briefly sitting in RS1’s accounts. Free working capital? A little interest float? Or just a glitch-prone system? To be fair, the system did briefly indicate a delivery window for Q3 2025, suggesting strong demand remains, even if chip export restrictions persist. But it raises the question: how often is this happening, and who benefits from these micro cash floats?

University - UK PBSA * RM Funds and its funds positions in named securities *

There’s been a noticeable pickup in interest around Empiric Student Property (ESP: LN) this week, coinciding with the company’s latest update. While activity is encouraging, a few points are worth highlighting. Neither the 63-bed acquisition nor the 32-bed scheme appears particularly compelling in isolation, small-scale assets like these often struggle to justify the operational intensity required to manage them effectively.

Add-on, the price paid for the Selly Oak apartments, at approximately £143k per bed, looks full. However, when viewed in the context of the surrounding c.360-bed cluster (430 post acquisition), the argument for critical mass begins to hold a lot more weight.

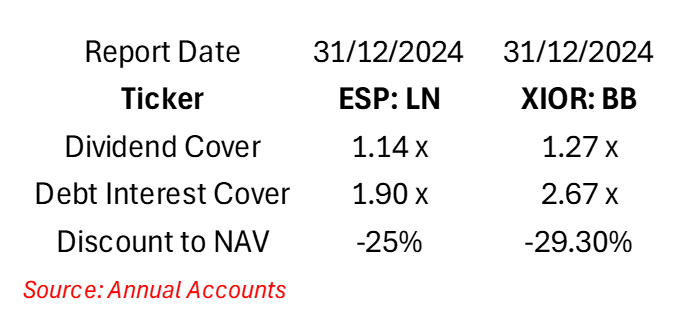

On the graduate apartment planning front, the combination of this site with the planning approval for a 57-bed office-to-student conversion introduces some optionality. We’ve previously financed office-to-student conversions, and they can be attractive under the right conditions, location and execution are key. Just going to leave this comp though re ESP vs XIOR..

Batteries Included * RM Funds and its funds positions in named securities *

This is shaping up to be a good result for shareholders in Harmoney Energy Income Trust HEIT: LN. The market continues to price in a greater than 50% chance of another bid [from Drax PLC, DRX: LN], and makes sense given they are a trade buyer with a business rational. A great read across to GSF: LN and GRID: LN!! GSF also sold its tax credits, which removes some of the energy policy risks facing the company’s assets. NOC covers in more detail our thoughts in his weekly comments (investors only).

KKR Atlantic Aviation..MIC?

Deals revisited. Back in the earlier days of RMII, we held Macquarie Infrastructure Corporation, an investment company that owned Atlantic Aviation, the monopoly utility and peak gen assets. Anyway, the relevance, KKR (via their Global Infra and Core Infra platform) acquired Atlantic Aviation in June 2021 for $4.475bn (proceeds received c.$3.525bn), implying a valuation equivalent of FY 2019 EBITDA of 16.2x (sold off the pre covid numbers). fast forward four years, and Atlantic Aviation is up for sale, either via a private stake or IPO, price tag $10bn.. nice IRR on that.. ching ching.

The long weekend has gotten off to a “bumpy” start, with a fender bender this afternoon (not my fault, i have the green slip!), just hassle – still impressed with the efficiency of the process.

I have a new book for this weekend’s road trip, Oil 101 by Morgan Downey, looking forward to reading it!

This week return of UAE Roastery NightJar, this time with a seasonal special “Gonzo”. Milk choc, good as macchiato and espresso 7.1/10

Espressos Consumed SB: 1502

P.

*************************************************************************************************************

🚨🚨6-12month F/T Internship / Industrial Placement🚨🚨

Investment team, working across equities and fixed income strategies

Key requirements: Math, problem solving, communication and attention to detail

Proficiency with Excel, PowerPoint, Python, and Java a material advantage

Applicants must have the right to work in the UK

*************************************************************************************************************