Musings from the trading floor (Bank Holiday Edition)

Names in play this week: £ESP, £UTG, £VMED, £SELNSW

Equities: UKX +2.15%, Eurostoxx +2.54%, ASX: 3.39%, SPX: 3.09%

Credit: IG, 1bps tighter, XO 8bps tighter

Interest Rates: 1Yr flat , 10Yr 1bps higher

Geo-Macro Mania

US: Initial Claims higher, GDP contraction, Core PCE hotter, NFPs higher

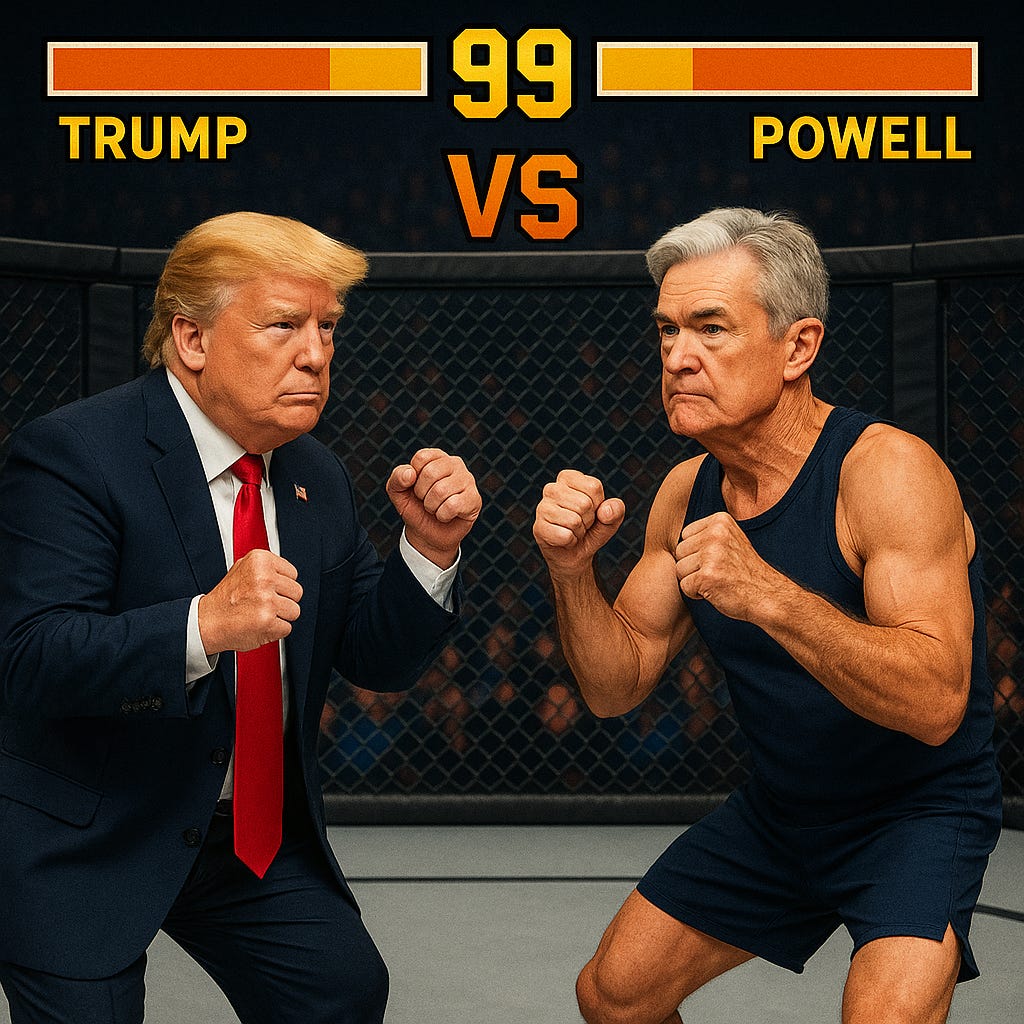

Ultimate Fighting Financial Championship

Their first round in Q4 2018 came with a US equity market correction, an early, and frankly successful, test for RMAI back in the day. Back then, the tension was all about fiscal tax cuts versus the inflation they unleashed versus JPow’s dual mandate. This time around it’s tariffs doing the heavy lifting, threatening fresh inflationary pressure and potential supply chain chaos, while JPow holds a measured but unmistakably firm line on tackling inflation.

This week’s early data reads were a bit of a mixed bag, maybe a little too soon to fully capture the liberation day effects: GDP contraction was worse than expected, core PCE came in uncomfortably hot, and initial jobless claims started ticking up. Some of that gloom was offset by Friday’s NFP numbers, but the overall signal is starting to flash amber.

On the high-frequency side, the team dug into some of the most price-sensitive segments, and there’s a clear upward trend emerging. I did have a far more dramatic chart showing the largest price spikes across categories, but it was a bit too terrifying and not exactly representative across the board. The real intrigue will be how this translates into US CPI, given that components like electricity and gas prices have diverged recently. So where does that leave us? While it’s possible markets start crawling out from the initial liberation day selloff, the countdown clock hasn’t stopped ticking. We’re staring at two clear scenarios:

1. Trump backpedals after declaring a win, market rebounds, dollar strengthens.

2. Trump digs in, goes toe-to-toe with the Fed, markets roll over.

Either way, we’ve built a countdown timer so you can track the trade event. https://bit.ly/RMFundsUStariff

Dorm and Gloom (PBSA)

The latest data from StuRents signals growing cracks in the UK Purpose-Built Student Accommodation (PBSA) market. As of March, just 36% of beds for the upcoming academic year had been pre-leased, down sharply from 46% a year ago, and marking the lowest level since tracking began in 2020. This 10-percentage-point drop suggests a meaningful slowdown in letting momentum, reversing the post-pandemic surge driven by pent-up demand. The softening is being compounded by multiple structural pressures: a decline in EU student numbers post-Brexit, tightening visa restrictions on international postgraduates, rising competition from global university destinations, and a cost-of-living squeeze prompting more domestic students to defer or skip higher education altogether. Reportedly over £2.5 billion in PBSA assets are up for sale and signs of oversupply emerging in key regional markets, investor assumptions of resilient demand are looking increasingly challenged (see Mondays PBSA note). The sector’s historic undersupply narrative is starting to fracture, raising tough questions about forward-looking occupancy and rental growth. Eyes on UTG: LN and ESP: LN.

TelCos Reporting

We exited our entire VMED CORP position during the quarter on concerns over fundamentals, a decision that looks prudent following Virgin Media O2’s mixed results. Revenues fell 4.2% year-on-year, with modest 0.4% growth excluding low-margin handsets and nexfibre construction. Mobile saw 123,000 contract subscriber losses amid intense UK competition, while broadband churn drove 44,000 net disconnections despite a 1.6% ARPU uplift. EBITDA was broadly in line, but rising leverage (5.5x including vendor financing) and higher net debt reflect ongoing cash burn. Management reaffirmed FY25 guidance, focusing on value retention as infrastructure competition continues to pressure KPIs.

Vending Machines..Selecta Restructuring

Selecta (SELNSW CORP) has secured €330 million in fresh funding and agreed to cut its debt by over €1 billion, as sponsor KKR prepares to hand over ownership of the company. While the exact breakdown of the debt reduction hasn’t been disclosed, leverage is expected to settle around 4x. We previously covered Selecta in March, the SELNSW 8 26s were quoted 35-40 this week and the PIK notes were quoted 0-5pts..

Ok it’s a bank holiyay weekend.

Have a great extended break. Moved back to a previous bag of coffee Toby’s Estates this week. Upgrading to 8/10 (Woolloo-Mooloo).

Espressos Consumed SB: 1540

P.