Musings from the trading floor (Another Late Monday Edition)

Names in play this week: £GSF, £AERI, £DIGFIN, £TALKLN

1st August 2025

Musings from the trading floor (Another Late Monday Edition)

Names in play this week: £GSF, £AERI, £DIGFIN, £TALKLN

Equities: UKX -0.57%, Eurostoxx -3.49%, ASX: -0.06%, SPX: -2.36%

Credit: XO 12bps wider

Interest Rates: 1Yr 1bps lower, 10Yr 8bps lower

Friday US Close.

War of the Words

War of the Words: So, the story of the week (at least in my corner of the universe), was of course the Gore Street Energy Storage (GSF: LN) Board and Manager response to our requisition notice. Its genuinely nuts, the level of hostility from the Board and Manager, blocking RM Funds and others from shareholder webinars, misleading claims regarding our engagement, hatchet job PR briefings, frustrating our legal rights and requests. Zzz. I even hear they are going door to door calling individual retail shareholders, must be something getting a call from the proxy advisors, asking shareholders to vote in favour of the Company, who has basically neglected them for the last 5 years..

Anyway, we will be issuing our response Monday/today here, and we invite all shareholders to consider, and ultimately urge them to vote FOR the RM Funds resolutions. We will also be arranging a webinar, sign up here 9am, Wednesday 6th August - Niall and I will present to investors on the matter.

Investment Management Agreements

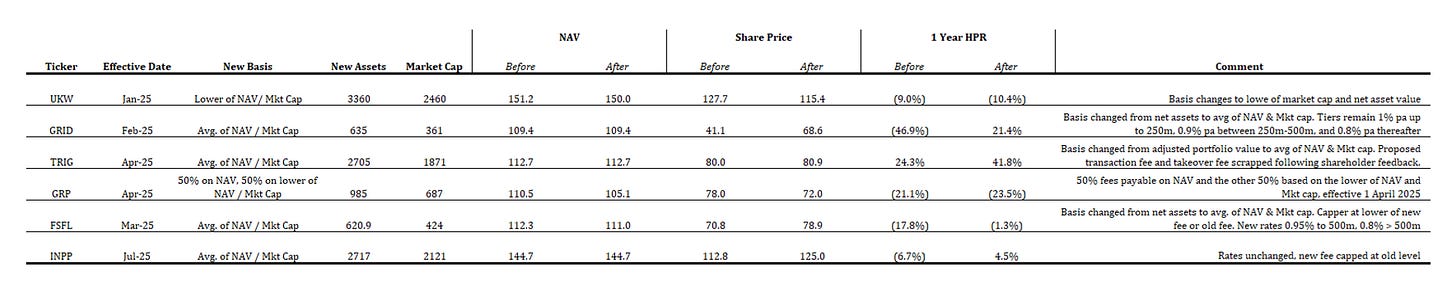

For the last circa 12+ months, the market in particular real assets, has seen management contracts rebased towards a blend or lower of market capitalization and Net Asset Value. This innovation is welcome by shareholders, as largely it addresses one of the major flaws in the closed-ended Manager remuneration model ie the NAV based, doesn’t align with shareholders actual share price returns – after all you cant “eat the NAV”..HOWEVER, we had a hunch, and its got legs.. it appears that in most cases, the NAV following the IMA remuneration rebase deteriorates in 50%+ of such situations.

Actual Musings

Aquila European Renewables (AERI: LN): Announced this (last) week that its preferred bidder has materially revised their offer, reducing both the number of assets to be acquired and the price offered. The Board cited difficult market conditions, including weak liquidity and pressure on power price forecasts, as key challenges. Its notable as there have a been a fair few disposals in Europe this year, on the private and public side, but at the heart of these transactions are a set of price expectations and marks which were probably materially off-market to start with..

Dignity Plc (DIGFIN): Announced the results of its Class A notes tender offer, originally capped at a £15m purchase price and priced in the range of 94.5% to 96.5% of face value. The company ultimately accepted £17.24m in principal, implying a total cash outlay of approximately £16.5m.

TalkTalk (TALKLN): Widely anticipated and announced on Friday that one of its key shareholders and junior capital providers has committed to provide £100m in new funding, including £60m of immediate liquidity and a further £40m in delayed-draw funding, available from March 2026. The new facility will be used for working capital, pays PIK interest at SONIA + 7.5%, and matures in February 2028. In parallel, the company has reached an in-principle agreement with 54% of first lien and 52% of second lien creditors to support the new funding and proposed amendments to its capital structure.

These amendments include an exchange of existing first lien debt for new instruments that rank senior to the new “1.5L facility” and pay PIK interest through to February 2028; non-consenting holders would see their claims subordinated and covenant stripped (ouch). Similarly, consenting second lien creditors who backstop the new funding can exchange into a new PIK facility due March 2028, benefiting from a circa 1.95x elevation on their backstop commitments. Non-consenting 2L holders would also be subordinated. The company is targeting completion of the transaction by the end of September.

Its been a long week. Coffee in-take reducing down to circa 1 espresso per day.

Espressos Consumed SB: 1677

P.

I can corroborate that I received a call on our landline Friday the 1st of August from a guy telling me about the requisition general meeting vote; I wish I'd recorded it. I asked who he worked for, he told me it was a subsidiary of Equiniti. His wording felt pushy. I can't remember for certain but I think he told me "that I had till Monday to vote", which surprised me; in any case I told him I'd already voted. I remember for certain that he asked me if I'd voted FOR/AGAINST the proposals. I told him it was none of his business.