Musings from the trading floor (Another Short and Sweet)

Names in play this week: £BBOX, £WHR,

27th May 2025

Musings from the trading floor (Short and Sweet)

Names in play this week: £BBOX, £WHR, FLNC 0.00%↑

Equities: UKX 0.28%, Eurostoxx 1.76%, ASX: 0.10%, SPX: 3.62%

Credit: IG, 6bps tighter, XO 29bps tighter

Interest Rates: 6Yr 1bps lower, 10Yr 6bps lower

UK Close*

Geo-Macro Mania

US: US core PCE 2.7% y/y vs 2.6% cons. Last month also revised up 0.1% to 2.6%.

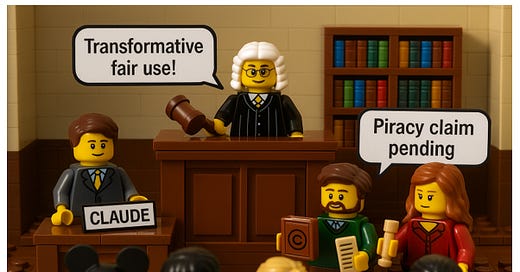

The Anthropic Copyright Ruling and its impact on IP monetisation

A landmark June ruling held that Anthropic’s use of copyrighted books to train its Claude LLM qualifies as “exceedingly transformative” fair use, allowing AI firms to legally ingest and repurpose creative content without paying licensing fees. This sets a precedent that threatens traditional IP‑rich businesses like Disney (DIS: US) and other public media companies - by eroding a core revenue stream: licensing. As AI models generate derivative outputs rather than direct copies, the market demand for original works may decline, significantly weakening publishers’ ability to monetise legacy content.

In response, major rights holders like Disney and Universal have filed their own suits recently sued Midjourney for allegedly recreating iconic characters without permission, seeking damages on a per work basis. But litigation is expensive; outcomes uncertain, and could expose IP owners to a new wave of legal vulnerability. Monetisation strategies are shifting: licensing deals may become more sporadic while firms increasingly resort to paywalls, subscription models, or bundling - raising costs and complexity. The financial impact could be profound, with IP-heavy companies facing both revenue decline and rising legal expenditures.

UK Muni Bonds – A Trip Down Memory Lane

This week’s announcement that the UK Municipal Bonds Agency (UKMBA) is closing to new business isn’t shocking - it’s the end of a long-winded plot with little audience. From the outset, it faced stiff competition from the Public Works Loan Board (PWLB), which provides local councils with long-term loans at costs just circa 80 bps above gilts, too good to refuse for most section 151 officers (equivalent to CFOs). I vividly recall the PWLB rate hike nearly 15 years ago - overnight, councils scrambled to find billions to buy public housing. My team advised numerous Section 151 officers, only for the government to revert rates months later, wiping out all that chaos (and financial advisory / DCM fees) with a blink of an eye. That episode underscored the chilling power of the PWLB and how easily capital-market alternatives were marginalized.

Why the UK MBA Failed, Financially Speaking

Despite investor support and ambitions to emulate the US $4 trn muni-bond ecosystem, the UKMBA could only land a handful of deals. After a decade of marketing, PFM exited its advisory role. The core issue remains financial: councils simply can’t beat the PWLB on price or ease; factoring in issuance costs, legal work, and structural complexity, the savings vanish. And with sterling corporate and muni issuance dwindling, part of a broader credit market shrinkage, the UKMBA becomes yet another project undone by cheaper, central-government funding. It’s a blow not just to the Agency but to the sterling market as a whole.

Actual Musings

Fluence: Fluence Energy ($FLNC : US) despite being caught in the cross hairs of the ITC/PTC tax credits fiasco from the US Government administration, now the market has clarity and storage is protected, the stock has popped up c.31% over the last month alone..

GoGo Gadget: BBOX: LN launching a cash/share offer for WHR: LN was a nice curve ball mid week. All keys on PE bidder now and whether we see a counter bid.

Limited coffee in take this week. No brewing. Goto this week was Pickwicks! Good to see clients this week.

Have a good weekend all, im flying back this evening!

Espressos Consumed SB: 1625

P.