Musings from the trading floor (A short weekly)

Names in play this week: £SPI, £LMP, €DG FP, £MERLLN

Musings from the trading floor (A short weekly)

Names in play this week: £SPI, £LMP, €DG FP, £MERLLN

Equities: UKX -0.74%, Eurostoxx +0.73%, ASX: -0.61%, SPX: +1.30%

Credit: XO 20bps wider.

Interest Rates: 1Yr flat, 10Yr 8bps higher, 5Y5Y Forward 5bps higher

Monday UK Close.

Actual Musings

(RM Funds may hold positions in some or all of the securities mentioned. CAPITAL AT RISK. Not an investment recommendation)

Meds: Spire Healthcare Group SPI: LN. Put itself in play. It’s a name we have watched for years, as a predominantly private hospital operator. The press were quick to run the Sale & Lease back angle, (c.£1.4bn of freehold property), on an undisturbed market capitalisation of around £900m – the pro’s and cons of the opCo / PropCo models are well trodden, but the other in my view obvious angle here is KKR/StonePeak. One of the likely reasons for the consortium bidding for the AGR: LN portfolio, was the fast growing private hospital portfolio, here they could pay a 25-30% premium and receive the OpCo for free! There is also the strategic “trade” investor: Mediclinic (29.78% holding) who previously bid for the Company (300p in 2017) – in short there is a lot of optionality.

UK Commercial Real Estate & the Golden Triangle

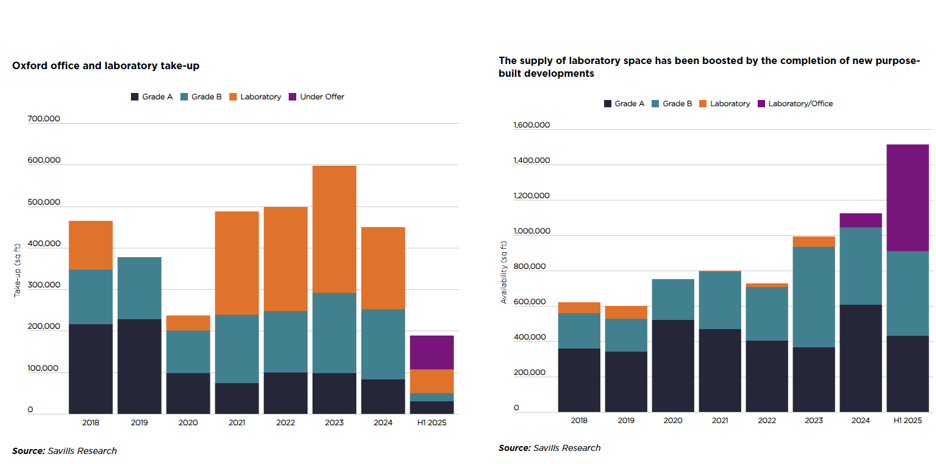

Savills was busy last week publishing multiple commercial real estate reports. Key takeaways: 1) 5.9% avg prime yields (offices); 2) investment decisions remain muted moving into Q4 due to UK budget considerations; 3) SE and provincial office yields look cheap on a relative basis; 4) office take-up remains below pre-covid levels in every market. Now turning to the meaty stuff, especially relevant considering the news that LABS: LN will sell its assets piecemeal. Supply has materially increased during H1 2025, adding over 500k sqft vs FY 24 (Cambridge alone), and office and lab take-up has collapsed in Oxford and was 17% below the 5-year avg in Cambridge. Rents ranging from £65-77 Sqft.

Merlin Entertainments (look through to LMP: LN)

MERLLN held their Q2 Mgt call, Management reiterated their focus on strengthening cash generation, highlighting that the £126m RCF draw was fully repaid during Q3. They also indicated that within the next 6 to 9 months they expect to turn more attention to addressing the 2027 bond maturities. While operating conditions remain subdued, particularly in the UK and US, with relatively firmer performance in Europe and APAC. Its hard to see upside here given the combination of this backdrop and the group’s elevated leverage (approaching c.10x post-IFRS 16).

Gatwick

GATAIR / GTWICK (Vinci DG: FP) Received its development consent order to utilise its second runway. The main value drivers for the Gatwick second runway project stem from its ability to unlock significant capacity and revenue growth with relatively limited capex. By shifting the existing standby runway 12 metres to meet safety requirements, Gatwick can convert it into a fully operational second runway, enabling simultaneous take-offs and landings and increasing annual capacity toward c.75-80 million passengers (from c.46m pax currently). The expansion will be privately financed, avoiding compulsory land purchase orders and now minimising regulatory uncertainty. Once dual-runway operations begin, incremental revenues from landing fees, passenger charges, retail and ancillary services are expected to scale strongly, given existing infrastructure and strong demand in UK air travel. A great result.

No new coffees this week. However Angus (our most recent hire) did acquire and gift yours truly a bag of Kopi Luwak (Civit Coffee) – its “processing method” is unique..

Have a good weekend all.

Espressos Consumed SB: 1736

P.