Musings from the trading floor (A short weekly)

Might as well state it here, we have launched a new Shareholder Activist “Corporate Engagement” strategy/mandate. 💀 Names in play this week: $MSFT, $JNJ, £WHR Ollie and June contributed.

30th May 2025

Musings from the trading floor (A short weekly)

Might as well state it here, we have launched a new Shareholder Activist “Corporate Engagement” strategy/mandate. 💀

Names in play this week: $MSFT, $JNJ, £WHR

Ollie and June contributed to the IG Corps piece.

Geo-Macro Mania

US: US Goods Imports fall 19.8% flashed across the Bloomberg Friday. Core PCE largely in-line, but yields a touch higher and US equity futures a touch lower on the news.

DEM: The ugly news for the German economy is the employment situation, with the unemployment rate hitting 6.2%, last since during peak Global Health Crisis.

JGBs

I've been pondering this week’s/month’s price action in Japanese government bonds (JGBs), and it's becoming increasingly clear that the yen once the funding currency of choice for the global carry trade is looking far less attractive and more expensive. We’ve seen how quickly carry trades can unwind when macro sentiment turns. Just last year, a series of negative macro prints triggered a sharp correction in Japanese equities, with the Topix falling over 20% in just three days.

It’s easy to dismiss this as somewhat disconnected from daily investment decisions. But history cautions against complacency. In H1 2007, when two of my former employers [Bear Stearns] hedge funds collapsed, the ripple effects seemed remote until the following year, when the global financial system was upended.

Fast forward to today: foreign inflows into Japanese equities and bonds hit a 20-year high in April, according to Reuters. While this may appear bullish, it feels more like a tactical anti-dollar / tariff hedge than a bet on Japan’s fundamentals. Beneath the surface, the structural picture is deteriorating. The Bank of Japan is stepping away from its longstanding QE program, reducing support for JGBs. At the same time, Japan’s debt-to-GDP has surged to +250%, drawing comparisons to the European sovereign debt crisis. This has already led to failed or weak JGB auctions, including a recent 20-year failure and a soft 40-year issuance.

Compounding the risk, Japanese investors historically among the largest holders of US Treasuries (with over $1 trillion in holdings) may increasingly repatriate capital as domestic yields rise, potentially placing upward pressure on UST yields. If yen strength accompanies that shift, it could act as a catalyst for a broader carry trade unwind.

A paraphrased quote from Charles Reed’s Calming the Storms, the Carry Trade, the Banking School and British Financial Crisis seems particularly apt here: “It should be realised that how low interest rates play an important role in stimulating capital flows and incentivising rash investment decisions, both of which are often followed by asset repricing and banking crashes when international interest rates converge again.”

One Big Beautiful Bill Act 9899

And speaking of catalysts, Section 899 on the Enforcement of Remedies Against Unfair Foreign Taxes has now passed the House. While there’s a touch of irony in targeting taxes that are ultimately borne by consumers in those foreign economies, the implications for U.S. Treasuries are more serious. The provision would impose a 5% withholding tax on coupon payments to certain foreign holders, potentially rising to 20%, making U.S. debt notably less attractive to overseas investors - just as the U.S. faces rising yield pressures.

US IG Corps

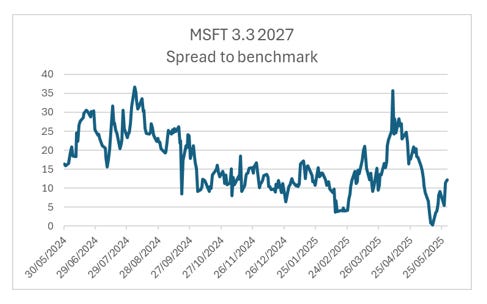

US IG corporates are grinding tighter across the curve some even dancing on the line of UST yields. MSFT 2YR is just 7bps over, and JNJ tighter still at 3bps. Further out, the story is much the same. MSFT 30Y has come in to under 50bps back of Treasuries, a tightening of 12bps since the end of February. Just like in the UK, we're seeing pockets of US credit price close to/through perceived risk-free. With persistent inflationary pressures on both sides of the Atlantic and governments increasingly lacking in fiscal discipline, this doesn’t feel like just a technical squeeze; we believe high-grade corporates will continue to outpace risk-free rates over the next phase.

This week it was the coffee: Falcon beans, Ethiopia Yirgracheffe. Concluding the bag. Not too strong, but pleasant. Previously scored.

2x Children’s birthday parties, a brunch and more family visiting. I’ll need a break after this weekend!

Have a good weekend all.

Espressos Consumed SB: 1582

P.