Musings from the trading floor (A Short Early Edition)

Names in play this week: £BT/A, £TALKLN, £DORE, £FSFL, £AGR, £PHP Ollie guest piece re BT/TALK

13th May 2025

Musings from the trading floor (A Short Early Edition)

Equities: UKX +0.36%, Eurostoxx -2.57%, ASX: +0.10%, SPX: +1.78%

Credit: IG, 1bps higher, XO 7bps higher

Interest Rates: 1Yr 13bps, 10Yr 13bps lower

Post lunch session, Pre-close*

Geo-Macro Mania

US: China deal *done*.. STC.., CPI a touch softer than expected.

IHT

*RM Funds mandates have an economic interest in the companies covered. *Capital at Risk*, Not a Trade Recommendation*

I had an insightful conversation this week with a professional in the IHT space, who pointed out that three of the major players: Downing, Foresight (FSG: LN), and Octopus - have recently raised significant amounts of capital for their IHT vehicles. What caught my attention was the nature of these vehicles and the rules around IHT eligibility, particularly the importance of unquoted and AIM-listed assets as qualifying investments. This makes two IHT-focused entities especially noteworthy: Blackmead Infrastructure (via its parent, Averon Park Limited) and Bagnall Energy. Both are significant because they currently rank as the #1 and #2 shareholders, respectively, in DORE: LN and FSFL: LN.

Another point of interest is that Averon Park was the vehicle used to take Foresight Sustainable Forestry private in Q2 2024. While it’s purely speculative at this stage, it’s also notable that FSG: LN has recently declared a notifiable interest in FSFL.

Dialling for Survival: BT Considering a TalkTalk Takeover?

BT (BT/A: LN) is rumoured to be considering acquiring the financially troubled TalkTalk (TALKLN Corp), which has struggled since Toscafund's debt-heavy £1.1bn LBO in 2021. Despite a £235m emergency injection last year, TalkTalk lost 400k customers (now at 3.2m) and faces severe cash pressures, including reportedly £60m/month owed to BT’s Openreach. Strategically, a BT takeover solves the Openreach payment impasse. Ofcom would likely support consolidation to protect consumers, echoing its stance in past distressed mergers (Virgin/O2, Sky/Telefonica) - But regulatory uncertainty remains with the CMA. Historically (the CMA is) strict (Sainsbury’s/Asda, JD Sports/Footasylum), but recent approval of Vodafone/Three (40% market share) suggests a shift. A combined BT-TalkTalk entity at c.36% broadband market share could now have a viable precedent.

If the deal stalls, TalkTalk’s prospects look grim. Its bonds signal a very distressed situation with limited recovery prospects (Senior unsecured yields at 45%, 2lien at 120% YTW). With £1.1bn debt maturing imminently and poor financial metrics, collapsing EBITDA, negative cash flow, soaring leverage, its standalone survival prospects appear minimal.

Actual Musings

Isreal / Iran: The hint was the evacuation of embassy staff this week, but with pre-emptive strikes on nuclear enrichment infrastructure and miliary capabilities, the escalation in the region could have increasing wider macro-economic implications – the obvious being this is an inflationary factor (shipping / oil / energy).

AGR / PHP: We like the RNS’ that keep coming. Still puzzled at why PHP: LN rallies each time it revises its bid, not your classic merger arb situation. Obviously our AGR bond trade is still on!

Picture(s) of the Week

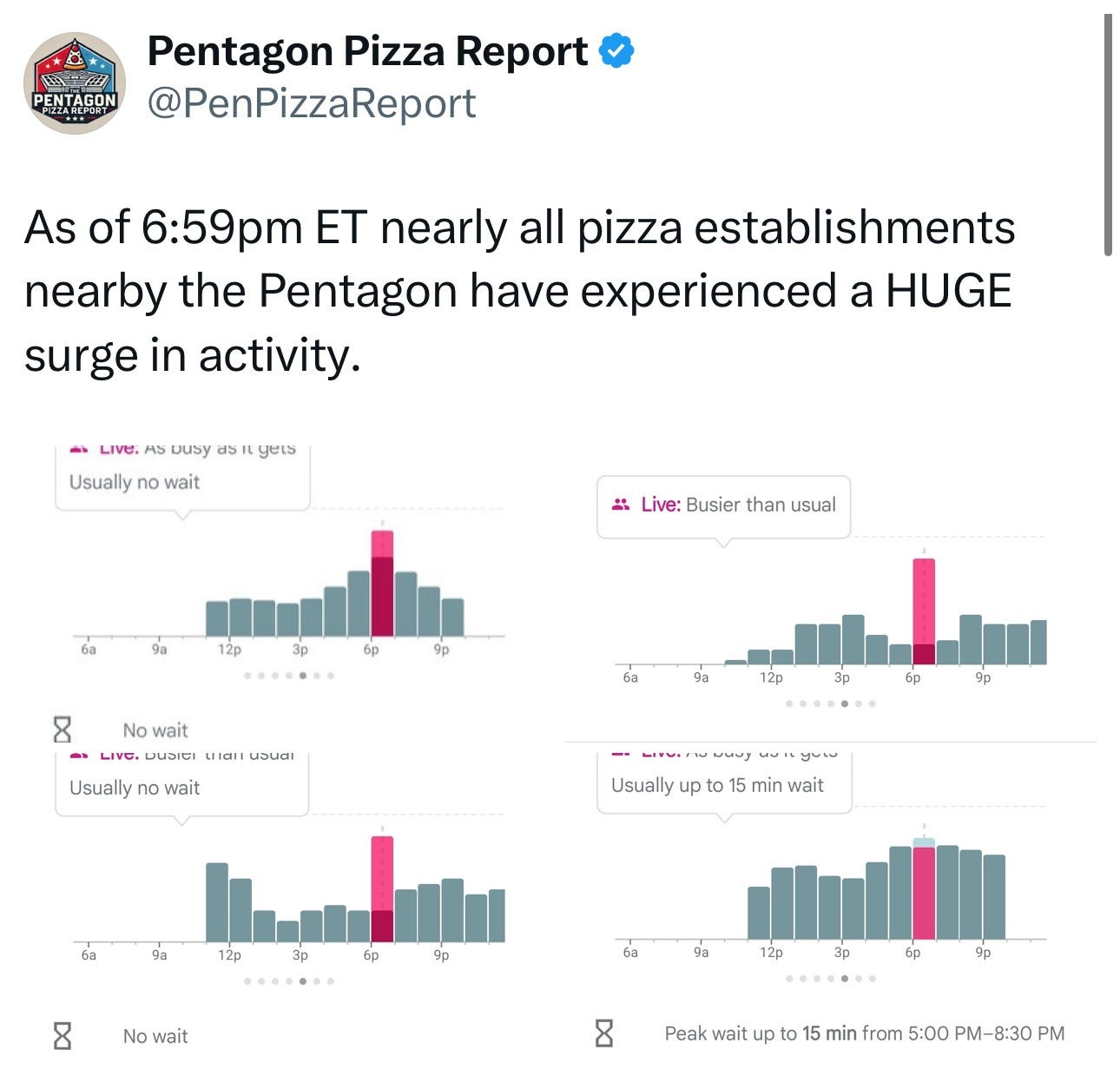

The best alt data set of the week was certainly this intel. Demand for take-out pizza, in pizzerias around the Pentagon, cross referenced with the closest watering holes, which showed a corresponding drop in demand.

A new bag of beans this week, this time from the Speciality Batch Coffee “Oscar Hernandez, Finca Los Nogales, Colombia. Taste: Fruits, specifically its strawberries and cream (seriously), and it works well as a macchiato. Very sweet coffee. Doesn’t have the classic espresso kick that i need though. 6.25/10

I had to panic buy a new tuxedo this week, ahead of the weekend black tie ball.

Have a good weekend all.

Espressos Consumed SB: 1606

P.